The news on the SFDR Regulation over the past 10 days has been dense, providing significant clarifications at a time when management companies are intensifying their work on the subject. On May 26, the European Commission responded to questions posed by the European Securities and Markets Authority (ESMA). On May 31, ESMA published a guide for regulatory authorities. On June 2, the ESAs published a clarification of the technical standards (RTS) of the SFDR Regulation. What novelties do these 3 publications bring?

These three publications insist on the level of clarity and precision to be had by Asset Managers, in particular on the characteristics, objectives and investment strategy. This echoes the very essence of the SFDR Regulation: a mechanism to promote the transparency of management companies and investors in order to guarantee better market clarity. The standardization of non-financial declarations on a European scale is intended to become a real decision-making tool for investors, professional or not.

Contrary to what the technical standards suggested, all Article 8 and Article 9 funds with environmental characteristics or objectives will have to publish the taxonomic indicators. For real estate funds, the collection and then the reliability of data is therefore a colossal challenge, even for those whose objective is not alignment with the Taxonomy. Nevertheless, doubt still hangs over whether or not to estimate all or part of the data for the calculation of the indicators.

Finally, the interpretation on the main negative impacts is clarified. There is no longer a requirement to disclose key adverse impacts at the entity level in order to do so at the fund level. ESAs make a clear distinction between environmental characteristics and negative impacts, the former representing a contribution to environmental issues, the latter a measure of any harm caused. However, negative impacts can be used as characteristics or targets if the indicators improve over time.

But this advantage poses a certain number of challenges, such as the multiple possible interpretations in changing news. In addition, the SFDR Regulation reinforces the need for reliable ESG data, and therefore the associated human resources. From now on, they have a place in their own right, in the same way as financial data, for all funds classified Article 8 and Article 9. The European Taxonomy makes it possible to converge these two reports to provide a common vision to investors. In the real estate sector, the challenge therefore concerns knowledge of the technical characteristics of assets and their energy consumption. Many actors are currently confronted with the complexity of consolidating unreliable collected data.

This regulation is based on the principle of double materiality. It consists of taking into account the risks in terms of sustainability, that is to say the risks related to external factors that would have a financial impact on the activity, and the main negative impacts, the impacts caused by the activity on external ESG factors.

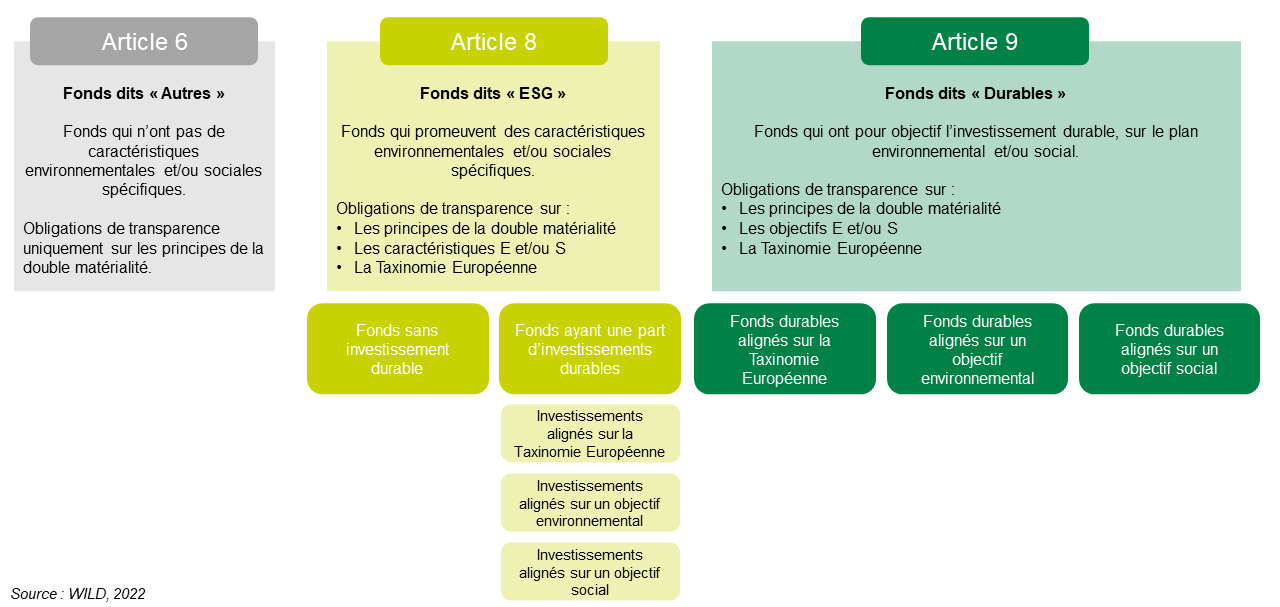

The transparency imposed by the SFDR Regulation applies at two levels for management companies: at entity level, the management company itself; and at the level of each of their funds. At the level of real estate funds, the SFDR Regulation offers different levels of transparency. Funds are ranked according to their ESG commitment; however, this classification is not intended to become a label.