The Paris Agreements of 2015 decided on a reduction in carbon emissions with the aim of limiting global warming to 1.5°C in 2100 (2°C being a less ambitious goal but often retained). As a result, strategic orientations aimed at achieving these emission reduction objectives have been defined at several scales, geographical and sectoral. In France, for example, the national low-carbon strategy (SNBC) aims to reduce scope 1 emissions by half in 2030 of emissions from buildings compared to 2015, and more than 95% reduction by 2050.

New regulations at the French level (Tertiary Decree, new Energy Performance Diagnosis, etc.) and at European level (environmental objective of Mitigation of climate change of the European Taxonomy) are also being used, through objectives concerning energy consumption, reduce GHG emissions from buildings in operation.

Today, the pressure on the extra-financial transparency of real estate players pushes them to continually go beyond regulatory constraints alone and to analyze in detail their alignment with a trajectory compatible with decarbonization objectives of 1.5°C or 2 °C.

What decarbonization tools and pathways can be used to achieve these goals? What information is needed to determine the current climate trajectory of its assets, and what are the levers for improvement?

In real estate operations, greenhouse gas emissions from real estate assets are mainly linked to the energy consumption of buildings. The carbon reporting protocols classify them according to two scopes. Scope 1 includes direct emissions due to fossil fuels used on site (gas boilers, for example), as well as leaks of refrigerants, gases with a high impact on the climate, used in certain air conditioning systems. Scope 2 emissions are made up of emissions related to indirect energy consumption: electrical energy, produced elsewhere but consumed on site, as well as energy from urban heating and cooling networks.

In 2022, players in the sector make widespread use of the Carbon Risk Real Estate Monitor (CRREM), a tool developed by the IIÖ (Institute for Real Estate Economics – Austria), a conglomerate of European universities as well as the GRESB, and financed by funds from the European Union.

CRREM trajectories, reference decarbonization trajectories

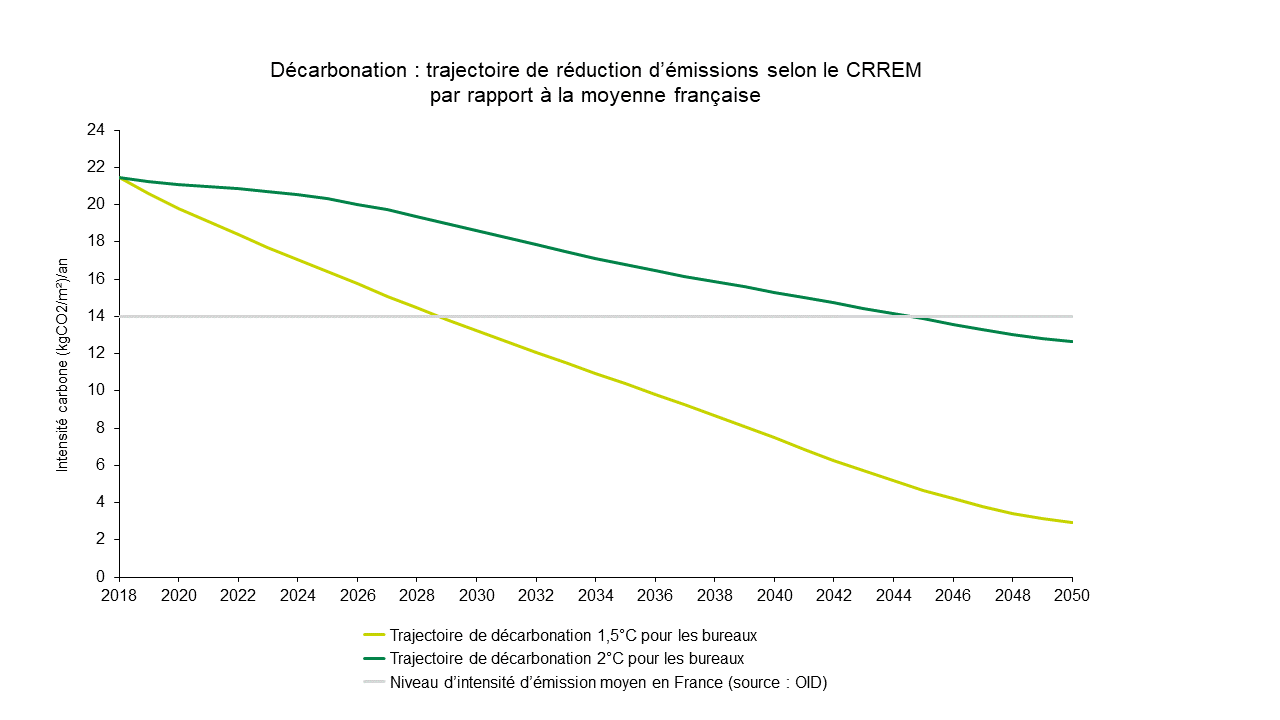

This complete and specialized tool in the analysis of carbon trajectories of real estate assets allows a better understanding of the carbon issue for buildings. It includes reference thresholds, decreasing over time, of carbon intensity (carbon emissions per m² and per year) that buildings must follow. These intensity levels are based on global IPCC scenarios and carbon budgets, to which real estate sectorization has been applied.

These carbon trajectories are broken down by country, by type of activity, by climate alignment at 1.5°C or 2°C; derived into an equivalent trajectory in energy intensity (energy consumed per m² and per year) of the assets. The climate alignment of the buildings analyzed is determined by comparing the carbon performance levels to be achieved with the emissions caused by their actual or forecast energy consumption.

According to the environmental performance of the asset, the CRREM concludes on the year of obsolescence of the asset. A very emissive building may be environmentally stranded (obsolete) from 2022, while an asset with high environmental performance will be 2°C-ready for 2050, or even 1.5°C-ready. In reality, for a certain number of buildings in France, the carbon obsolescence frontier will be crossed by 2050. This therefore means that these buildings are today in performance levels consistent with a 2°C alignment, but will remain so in the long term only by anticipating the decarbonization of their energy consumption.

Outstanding results to initiate the low-carbon transition

The Offices indicator of the Sustainable Real Estate Observatory allows a fairly powerful application of these principles. In 2021, an average building emitted 14 kg of CO2 equivalent per m² per year, so it would be considered to be in line with the CRREM’s 1.5°C carbon objectives until around 2029 (see graph below). On the other hand, this date having passed, this average building would be in carbon obsolescence: it will have to gradually decarbonize its operation to align, until reaching in 2050 an intensity of emissions around 3 kgeqCO2/m²/year, i.e. a division by one little more than 4 of its footprint!